Published

23rd October 2023

Categories

Perspective News, The Cambridge Weekly

Share

The Cambridge Weekly – 23rd October 2023

Bonds yield volatility has markets guessing

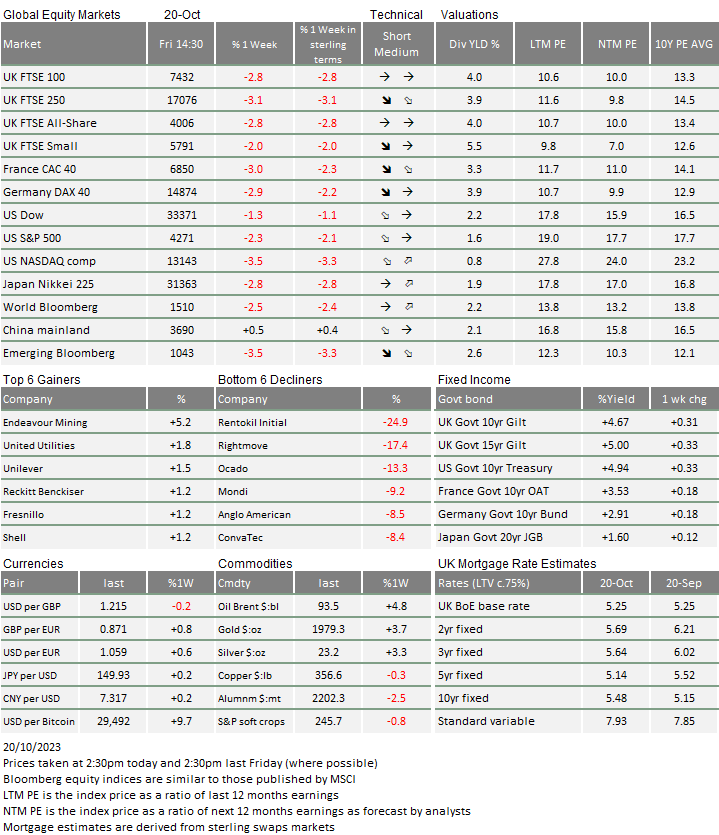

While the human suffering in the Middle East conflict worsened as expected last week, it has not yet spread further across the region. Therefore, and as we wrote last week, markets have not particularly acknowledged the rise in geopolitical risk temperatures beyond the slight increase in oil prices that was already under way a week ago. Nevertheless, the extraordinary volatility in long bond yields continued as the global benchmark US 10-year government yield yo-yoed between 4.5% and 5%. This in turn impacted equity valuations and hence this increase in the bond term premium (risk premium for accepting fixed yields for longer periods) remains at the centre of talk at Wall Street and the investment community at large.

For example, Goldman Sachs researchers wrote: “We are exiting the abnormal era of cheap capital, a focus for growth and a reach for yield. That path to normalization will be (has been) bumpy. It will come with false bottoms and fake rallies. Still, Covid-period ‘cash and dry powder’ remains available. The delayed effects of that saving creation has been felt in the resilience of the consumer and consumption habits… for how long that lasts is one big question with increasing signs of belt tightening.”

We write about this and other aspects in a separate article about US savings rates.

Part of our job is to try to find some indications of how the near-future might look. To do that we look back to find other periods which share similarities in some way. Of course, turbulent times are the most fully recorded, so there is a tendency to compare now to the most difficult situations. Professor Niall Ferguson is a well-read and known historian and his 15th October article in The Times drew some very daunting parallels with the 1970s and the 1930s. On reading the article, investors would and should now want to be paid more of a premium than before for locking up their money for fixed time periods.

But history cannot be a science, because there are just too few comparable periods and our recording is biased; we remember less well the times when things looked horrible but then nothing happened. Moreover, these periods are not ‘homogenous’ – only certain aspects are similar. So, Professor Ferguson’s words should not be treated as a prophecy, but as a statement of downside potential and a spur for action. And the greatest urgency for our leaders is to try to make sure we learn from history, so the mistakes of the past are not repeated. Biden, Scholz and Sunak are to be commended for their diplomatic visits to the troubled areas.

Still, investors now want more reward for any new investment beyond cash. What’s been interesting in the past weeks is that the biggest relative change in required risk premium (that incentive of extra expected return) has been in the assets generally described as the least risky – government bonds. The 10-year US Treasury yield traded at 4.992% last Thursday. Some of this rise is attributable to rising inflation fears although (oddly, given the oil price rises) not in the near-term – the fears seem to be more visible in five years’ time.

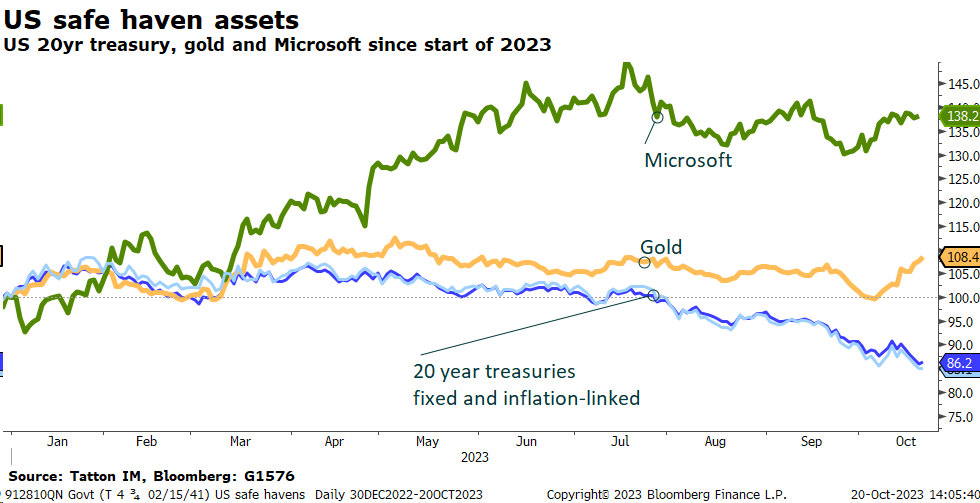

It seems that investors hear the words ‘risk-free asset’ but perceive long-term US Treasuries bonds as one of the riskiest of defensive assets, and perhaps it’s not just about the losses these securities inflicted on holders in 2022. The last few days have been particularly instructive. Gold has rallied quite hard, up 8.5% since the Hamas terrorist attack. Usually, gold price movements move quite closely with inflation-linked bond price movements. This time they are moving in opposite directions.

US investors are not the only holders of risky US assets, of course. Oil producers and manufacturers of goods earn lots of US dollars and generally ‘store’ a good proportion of the proceeds in US dollar financial assets. However, in the current situation, they might find their ability to liquidate those assets without the risk of short-term losses being substantially constrained.

In terms of incentives for other external holders of US financial assets, the US policy of imposing financial sanctions may well be starting to rebound. Last week, US data showed that China has been disinvesting from US dollar assets since mid-summer. Now, the Middle East oil producers may be doing the same and putting the proceeds into the safe haven asset they have trusted for even longer than US bonds.

In our long-term measure, gold has been relatively expensive to bonds for some time but our measure depends on the view that you can sell the asset and get your money with equal ease, and it may well be that some people don’t believe them to be equal now. (Interestingly, crypto currencies do not seem to be benefitting nearly as much, despite this being an environment that seems made for them).

The case is being made by some commentators that US bonds are being hurt by the possibility of a worsening in the US fiscal deficit, amid the conflicts in Israel and Ukraine, while the rise in interest cost is also a factor. However, at the moment, they are trying to ration the volume of new borrowing. Neither side of the political divide is proposing emergency spending. As we know from our experience here, markets take serious fright more when politicians feel fiscal discipline is not necessary.

So the shift upwards in bond risk premia may just be about bonds. While non-US investors have exposure to equities, it is significantly less important. But neither should we be complacent either. We are in the full spate of third quarter earnings announcements, which are unsurprisingly full of positive surprises, albeit with some negatives (such as Tesla last week). Still, the theme of larger companies holding up but smaller enterprises being stressed keeps coming through.

US Federal Reserve (Fed) Chair Jerome Powell gave an even-handed assessment of monetary policy last week, and acknowledged that the rise in long bond yields was tightening policy without the Fed having to change anything. The markets took that as indicating interest rates were not likely to go any higher than one more 0.25% rise. We would note that one-year yields are still at the same level as the end of June, not brilliant since it means that the expected first round of rate cuts has moved out by the same amount of time, but this is not catastrophic either.

The danger for investment assets is that the further tightening of financial conditions leads to a downswing in earnings expectations. To some degree, this has already happened in smaller firms’ estimates, but it has not particularly hit the larger ones. Nevertheless, they are not immune either as we saw around the end of last year. And, as we explain in the article below, US households have been able to keep spending partly because their financial assets have done fairly well. A fall in equity prices therefore has the potential to create a slowing in spending, rather than slowing spending causing a fall in equity prices.

Credit spreads as indicators of recession fears rose in the derivatives markets, but less so in the cash traded actual bond markets, something which tends to indicate precautionary hedging but not disinvestment. At the same time, the fall in equity prices last week wiped out the gains from earlier in the month but, as yet they are not signalling a change in investor belief in earnings growth.

Meanwhile, the yield moves in Europe have been notably less than in the US. Growth is weaker, which is not great for assets, but keeps a lid on yields to a large degree. The key risk remains around gas and electricity prices, which currently are reasonably well behaved. UK gilts were hit harder last week, which will hurt our softening economy further, although mortgage providers are doing their best to hold fixed rates from going much higher.

To sum up, it may be reasonable to draw as a conclusion from the raging debate about the reasons of the term premium moving bond yields that this inflation fighting tightening cycle may have indeed reached its nadir. Therefore, the emerging crunch point is whether the higher rates and yields are slowing activity just enough to declare victory over inflation (so we get away with an economic soft landing over the coming months), or whether the additional dynamics introduced by the ‘collateral damage’ of the high yield environment leads to an acceleration in the slowdown – or even possibly trigger a credit default cycle – all of which causes central bank tightening to turn into a policy error outcome that leads to a hard landing recession.

We continue to watch credit spreads and stories related to default stress, which have increased but not to worrisome levels. Market liquidity remains good and intraday volatility well within the usual boundaries. This can all change quickly, but currently give little reason for concern, but equally the conditions are not tempting us to declare and position investor portfolios for one outcome or the other.

Chip cycles and tech bubbles

The microchip industry is in an odd place. On the one hand, investors have been eager to eat up anything related to the generative AI boom. This has given a huge boost to companies like high-end chipmaker Nvidia, whose share price has risen an eye-watering 192% year-to-date. On the other hand, more ‘traditional’ semiconductor manufacturers – those specialising in large-scale production of run-of-the-mill microchips – are struggling under the weight of a substantial cyclical downturn. Following a period of severe undersupply during and after the pandemic (regular readers will remember), now, for more than 18 months, the global microchip market has been in acute oversupply. Some analysts even think that global semiconductor revenue will decline for the first time since 2019, and many chipmakers have announced plans to cut back production or capital expenditure.

Last month, British chip designer Arm raised $4.87 billion in the biggest initial public offering of the year. Trading in the newly issued shares has been choppy since, though, with them falling 25% from their IPO peak, then subsequently bouncing around the initial listing price. The company – whose designs feature in almost all smartphone chips around the world – encapsulates the conflicting market pressures on semiconductors. Owners SoftBank have tried to present the designer as a growth company at the leading edge of AI and cloud-related microchip design, in part because of its connections to Nvidia’s cloud computing technologies. But many analysts are unconvinced, viewing Arm more like a utilities company (thanks to its essential role in the stagnant smartphone market) sensitive to global manufacturing cycles.

The irony of this is that one could argue both trends should be rethought. While no one doubts AI’s ability to transform business and everyday life, there is a strong argument that investors got too excited about the new technologies, rewarding companies just for mentioning buzzwords like “machine learning”. Markets have more tempered in recent months, with Nvidia currently at the same valuation it achieved in mid- August.

Nvidia specifically has been hit by the US government’s decision to stop it selling high-end microchips to China – where 25% of its data centre chip revenues reportedly come from. Controls were introduced a year ago, but the Biden administration last week announced a tightening of restrictions to curb China’s technological advancement. Nvidia shares – previously the darling of tech investors – have fallen by 9% in the last week. It is a reminder that, even if the technology itself is genuinely transformative, it means little to businesses if they cannot (either through ability or government intervention) capitalise on it.

The flipside of this for chipmakers is that the cyclical factors holding them down are arguably improving. Since the start of September, there has been an unmistakable pickup in prices for older microchips, like those used for memory and ram. This seems to be due to producers finally running down the bloated inventories they built in reaction to the previous severe supply shortage – which have hung over global chip markets since March 2022. Near-term revenues are still in decline, but the medium to long-term picture looks much brighter.

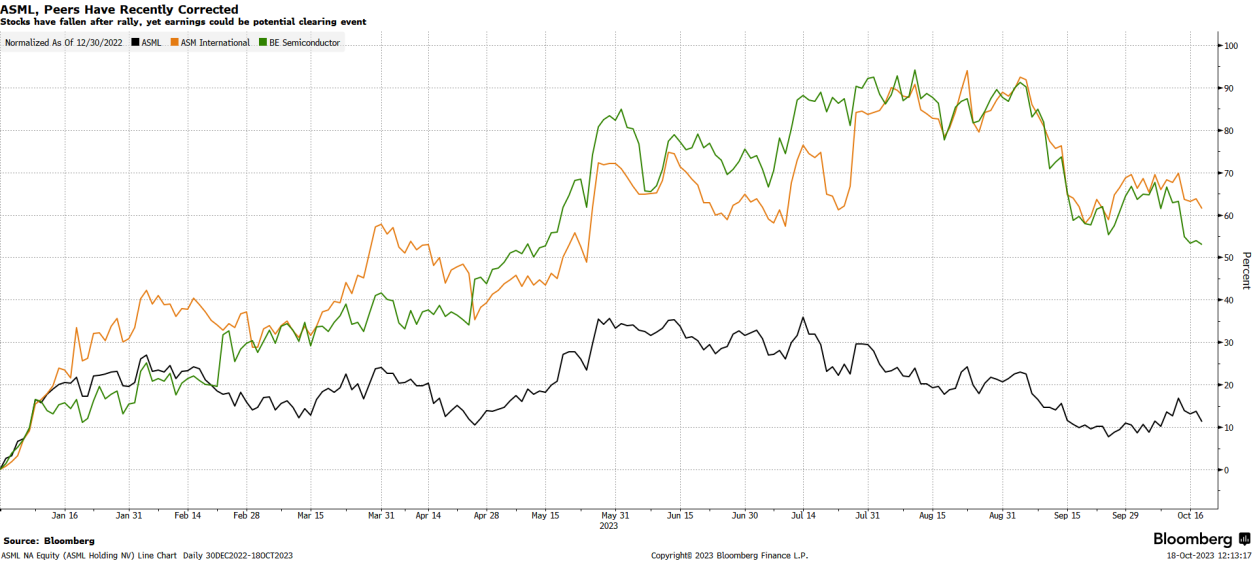

Dutch manufacturer ASML – which provides the machines for mass chip production – is a good example. The company released its Q3 results last week to a mixed reception, beating the current quarterly expectations but projecting lower than expected earnings for the last three months of the year. This has not affected longer-term projections, though, with earnings guidance for 2025 to 2030 maintained. This suggests that supply and demand are coming into balance, after an extremely long supply overhang by industry standards.

The chart above shows the share price performance of ASML and its peers through 2023. ASML has lagged other producers, and the wider industry has suffered pull backs in the last few months. But all are up from the start of the year, and at valuations that look much less stretched than their AI-related counterparts, according to a Bloomberg article. If global demand also starts to pick up – either through anticipated monetary easing in the west or China finally delivering on its promised growth – the chip sector will be extremely well-placed to take advantage.

All of this shows just how cyclical the semiconductor industry has become. The acute shortage of microchips was one of the biggest economic stories of the pandemic era, with the intense supply-demand mismatch leading to waiting lists for cars, games consoles and virtually everything in between. The overproduction that resulted from this – along with the sharp drop off in global growth and demand – created the supply overhang that hampered the industry for the better part of two years.

Now, chip prices have improved a great deal, while chipmakers are still suggesting production and capex cuts. If global growth is even slightly stronger than expected over the next year or so, that could easily lead to another undersupply. That would mean higher prices and further capex – pushing the cycle round again. One could easily argue that current chipmaker stocks are therefore undervalued relative to AI-propelled peers, certainly if the US Federal Reserve achieves its fabled ‘soft landing’ and eases interest rates without ever triggering a damaging recession.

Saying this about the industry as a whole is difficult, since many chipmakers – like Arm – are involved in both the innovation side and the more traditional utilities-style side of semiconductors. What it suggests to us is that structural stories around AI and innovation may have their place, and will be especially visible in hindsight, but cyclical factors driven by supply and demand are at least equally important. Rising demand or depleted inventories tell us a lot about the likely fate of chipmakers.

How far can Americans fun down their savings?

One of the biggest investment topics over the last few years has been so-called “excess” savings. Over the pandemic, consumers across major developed economies tucked away huge rainy-day funds, some of which were spent as the world opened up. This is usually cited as a major factor behind the extraordinarily resilient economic figures seen. Surging demand propelled growth and ultimately resulted in a mismatch between the burgeoning money supply and the dwindling stocks of goods or labour. Central banks have therefore paid close attention to consumer savings. And as we come to the inflection point for global interest rates, predicting what will happen to excess savings is crucial to any outlook for inflation or monetary policy.

What this means in practice is much harder to tell. The idea of excess savings is very abstract, referring specifically to the difference between consumer savings during the pandemic and the theoretical amount the same consumers would have saved otherwise. Economists are unanimous that lockdowns and fiscal handouts caused consumers to save more than they normally would, but putting a precise figure on this requires figuring out what the “normal” rate would have been.

This is often assumed to be the pre-pandemic trend, but there is no particular reason to assume that previous long-term trends would have continued even without the pandemic. according to Liberty Street Economics (a.k.a Federal Reserve researchers’ blogpost), the US five-year average for household savings as a proportion of disposable income, for example, was 6.37% between 2015 and 2019. But this had already jumped to 7.6% in 2019. If the latter figure was used for comparison, the total savings pile built up would be substantially less.

Then there is the question of how much of those excess savings are still available. Larger spending reserves clearly had a big impact on post-pandemic growth in developed economies, but not equally so. The US, experiencing the highest and most consistent GDP growth, also saw a sharp reduction in consumer savings rates as we came out of the pandemic. Others, like the UK and Eurozone, still have savings rates above their pre-pandemic averages.

We should point out that excess savings – the total amount of additional savings built up by consumers during the pandemic – are different to savings rates, as measured by the amount households save as a percentage of their disposable incomes. This makes it much harder to judge how much of the excess savings pile has been spent. US savings rates, for example, have come down well below pre-pandemic trend (4.01% average from 2022 to present, according to Liberty Street), but this in itself does not mean savings have been spent.

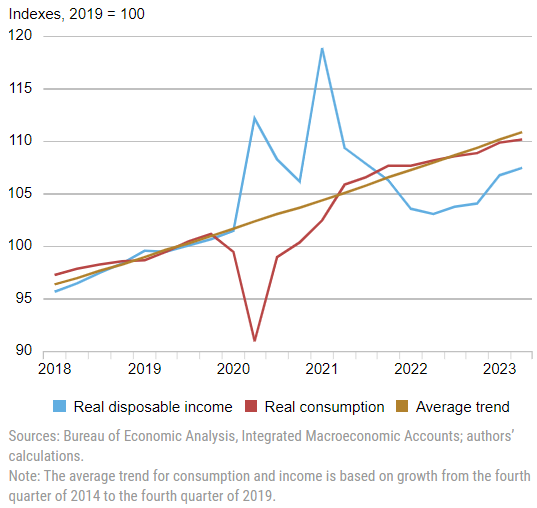

Answering that question requires looking at the gap between income and expenditure. The chart below shows the five-year trends in US real (inflation-adjusted) disposable income and real consumption.

The huge mismatch in 2020 led to a massive surge in savings, but incomes have since dropped well below consumption compared to the previous trend. Americans have had to fund the gap some other way – which is way the intense savings drawdown has come into play.

This is very clearly a US-specific phenomenon. Estimates of remaining excess savings from other high-income countries show that they have plateaued rather than dropped off. This might be because of lower consumer and business confidence in those areas (for example due to intense energy price shocks in the UK and Europe) but it has certainly dampened growth compared to the vibrant and surprisingly resilient US economy. US outperformance has in part been down to Americans’ willingness to spend their reserves, and in part down to the multiplier effect this spending has had on businesses, employment and growth.

US consumers can only maintain a gap between income and expenditure for so long, however. Back in June, Federal Reserve Board economists predicted that US excess savings would run out by the third quarter of 2023, at which point, one would expect consumption to fall back in line with underlying real income, which itself is slowing. That suggests a significant slowing of US consumer demand, bringing down both growth and inflation.

This scenario is broadly in line with the latest economic data, which has shown a cooling of US growth without an outright downturn, and it also makes sense of the Fed’s recent pause on interest rates. But on the other hand, betting against the US consumer has been a losing game over the last few years; Americans have been incredibly resistant to things that we might have thought would knock their sentiment or spending habits.

Another crucial factor is the so-called “balance sheet effect”, whereby asset appreciation encourages greater spending by firming up household balance sheets – or in other words whether households feel richer or poorer. US house prices, for example, rose sharper than in most countries during the pandemic and, while these have dropped off recently, American households are still better off in this sense than British or European counterparts. Perhaps even more important for the US specifically is the stellar performance of its stock market – which has grown significantly more than any other major economy over the last few years. Americans, more than most developed world consumers, are big investors in their own stock market. Its stellar performance has had a direct impact on their abilities to spend.

That being said, US equity outperformance has left US stocks with significantly higher valuations (in terms of price-to-earnings multiples) than other markets. For multinationals like the big tech firms, these have become particularly stretched as the dollar has appreciated against other currencies. For this situation to continue, international investors would have to accept lower earnings from US equities than they would get if they invested in their own markets. That could happen if the US is seen as the best bet over the long- term, but that again comes back to how long Americans can go on drawing down their savings.

A reversal of this trend could be triggered by a US financial shock, though that does not look likely at the moment. It could also come from a sharp reduction in US fiscal spending, for example under a deficit-busting Republican presidency. All of these scenarios are shrouded in uncertainty. US outperformance has no immediate threats, but with savings in the balance, it looks more fragile than it has in years.

If anybody wants to be added or removed from the distribution list, please email enquiries@cambridgeinvestments.co.uk

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg/FactSet and is only valid for the publication date of this document.

The value of your investments can go down as well as up and you may get back less than you originally invested.