Published

11th March 2024

Categories

Perspective News, The Cambridge Weekly

Share

The Cambridge Weekly –11th March 2024

At least currency markets noticed the budget

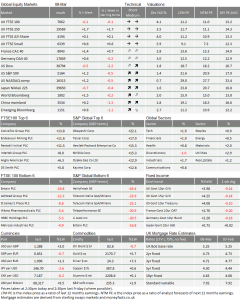

Last week saw global markets showing gains again. The UK Index of larger listed companies is a little lower but the US S&P 500 hit another all-time high, driven by renewed interest in megacaps. Bond prices rose and sterling is stronger against the US Dollar. And yet, if you look at our data table, it shows negative equity index returns. So, what is going on?

When Sterling strengthens, it means that, for us, assets priced in other currencies weaken – and Sterling has risen by about 1.5% against the US dollar during the past week. That strength may be partly down to the budget.

Jeremy Hunt and Rishi Sunak did not announce a great deal, despite engineering a lot of press interest in the weeks leading up to the budget. The Office of Budget Responsibility did what it should, telling the Chancellor of the Exchequer that he had no room for largesse if he intended to keep to his own rules. To his credit, Hunt took it seriously and gave little away.

The cut to National Insurance Contributions is welcome, and marginally improves the growth potential for the economy. The freezing of fuel duties was mildly political and ultimately will be lost on the target voter base. The extra British ISA allowance is seen by most in our industry as an extremely disappointing response to the obvious domestic investment problems; a sop, rather than a step in the right direction.

And yet, even this small offering has been a factor in last week’s Sterling appreciation. There appears to be a growing optimism among foreign investors that domestic Sterling assets offer reasonable returns. And after last week’s disappointing performance in UK small caps, the index of medium-sized UK listed companies has handily outperformed the index of larger listed UK companies.

Rishi Sunak does not look likely to remain as prime minister, but overseas perceptions about the UK have improved substantially since he acceded to the post, following the Liz Truss economic debacle. Indeed, conversations with contacts abroad revolve around the likelihood of a relatively smooth transition from one centrist government to another, with the current administration doing little to make life too difficult for a new one.

Seen through that lens, the budget was a success. Jeremy Hunt did not do anything to raise the cost of borrowing, for which mortgage holders and the Labour Party will thank him. The Labour Party will probably borrow more to invest if the cost of borrowing is not exorbitant, and he has not done anything to change their calculations.

Another factor in Sterling’s appreciation against the US dollar is that the European Central Bank (ECB) left short-term rates unchanged last week. The Euro also rose, though not quite as much as Sterling. There was little in ECB President Christine Lagarde’s post-decision comments to suggest anything other than a rate cut by the Summer. She is much more a political animal than her predecessor, Mario Draghi, and so it is less obvious how much debate is happening within the council. But the markets sense a continued hawkishness and a reluctance to be first among the developed nations in cutting rates. Wage rises are holding them back, and the ECB can clearly see that global growth prospects have warmed a little. The February and March inflation data points will be key and we – along with most other investors – expect them to be low enough to warrant an ECB move.

Of course, the reality is that currency moves are not directly linked to the words of central bankers. We might think the ECB was being a little hawkish, but the same could be said about the chair of the US Federal Reserve Jerome Powell’s testimony to Congress, in which he also suggested little room to cut rates.

Investors suspect that a cut is closer at hand, amidst less vibrant US economic data. Last Friday’s release of the February employment report was a case in point. January’s release had been a staggering gain of 353,000 and February’s rise was almost as high at 275,000. However, the data is highly suspect, and the revisions keep offsetting the gains. Revisions to December and January data have removed 167,000 jobs from the initial reports, with January being marked back to 229,000. That’s much closer to what the market had expected.

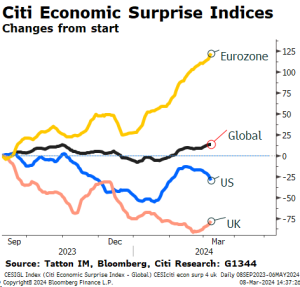

Data from the US is not bad, but it is now less surprising in its strength. Using Citi Research’s Economic Surprise Indices to track how regions are performing relative to consensus, the chart further down shows the US trailing off compared to the rest of the world.

Europe has been in a clear recession over the past six months, with the UK almost as weak, whereas the US was very strong in the Autumn, and has been seen as strong throughout. However, the chart shows that the US has not beaten the admittedly lofty expectations for a while, and is now underperforming them. In the UK we have seen disappointment, but our data has begun to be less disappointing. Meanwhile, the Eurozone has actually been rising compared to economist expectations. Even though data can be soft, a region’s markets and currency can perform well if the data is better than more downbeat expectations.

Because we write every week, there is an inevitable tendency for us to focus on the things that change. We do think that the US dollar’s softness is noteworthy. However, while the shifts in currency may mark a change in trend, they are not especially large. Indeed, what is most notable is the lack of change across many markets – bonds, equities, currencies and commodities. Volatility has declined to the levels seen before the pandemic, and is running below that level in a number of cases. Low volatility is often associated with markets that have strong savings inflow, and that also goes with expensive valuations. That appears to be the case now, with low credit spreads in bond markets and relatively high price-to-earnings ratios on stocks (after adjusting for the rise in bond yields since 2022).

High valuations can be seen as signalling investor expectations of reasonably strong and consistent growth. They also tend to go hand-in-hand with periods of mild capital gains, rather than strong ones. The outlook remains generally beneficial, but we are likely to see a lot of weeks similar to this one; small gains for investors and thankfully without much drama.

Returning M&A returns?

The trend of increasing Mergers and Acquisitions is picking up. It became noticeable a few weeks ago when we wrote about the bids for the British retailer Currys, and US-based Capital One’s capture of Discover Financial.

Corporate deal activity tends to reflect both business confidence and financial conditions. But they are expensive, time-consuming and risky, since they might fail to complete or ultimately destroy value. It is therefore no surprise that the recent bout of M&As comes as capital markets are in a buoyant mood.

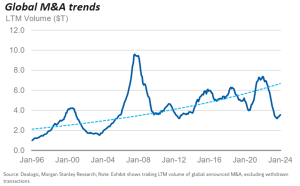

We are not alone in predicting a broad increase in M&A activity, partly because the past year has seen substantially fewer than normal. Rapid interest rate rises across the developed world have weighed heavily on companies for the better part of two years. M&A activity plummeted through that period, as extraordinary pandemic-era liquidity drained away. As the chart below from Morgan Stanley Research shows, M&As went from a decade high back to the post-2008 recessionary lows, and that’s without accounting for inflation.

The chart also shows the recent turnaround. Since this is coming from an extremely low base, and well below trend, this can be attributed to short-cycle effects. However, the macroeconomic environment is helping. Compared to last year, financial conditions have eased and there has been a broadening improvement in the economic outlook beyond the US.

Rather than just a short-term increase, US investment bank Morgan Stanley thinks that a more sustained rebound is coming. Their analysts expect a 50% rise in M&A activity for this year compared to 2023, and point to medium and long-term factors, with corporates now catching up from the last few years low activity.

Those years were exceptionally quiet for corporate deals. M&As require both motive and opportunity: companies must see the sense in doing a deal in terms of long-term returns, and they must also have the financing to make it possible. During the pandemic, the flood of central bank capital meant opportunity in abundance, but, when central banks hiked rates at the fastest pace in a generation, this turned into a drought. Dramatically higher financing costs limited opportunities, while the subsequent economic slowdown lessened the motive.

Interest rate rises have paused in the US, UK and Europe, and markets are convinced they will reverse this year. With monetary policy expectations moving to ‘looser’, it might seem obvious that companies should have more money to cut deals. But, rates have not been cut yet, and it is not obvious why a move in future expectations of borrowing rates should increase the current ability of companies to find funding.

That M&As are already picking up is in part down to improvements in corporate balance sheets, as well as credit spreads – the difference between corporate and government bond yields – coming down. Years of tougher financing have led to a reduction in overall leverage (borrowing to finance deals), but now improving monetary and economic expectations have made investors more willing to lend to businesses.

However, the capital companies offer in M&A deals does not have to be cash. Capital One’s acquisition of Discover Financial was an all-share agreement, for example. Rallying stock prices since the Autumn – particularly impressive in the US – have given companies greater ability to buy out or merge. For the most part, the rally has been stronger for bigger companies too, meaning the mega-caps have higher valuations with which to swallow up smaller competitors.

Despite rate rises – or perhaps because of them – both companies and private investors still have a huge amount of money ready to invest. This so-called ‘dry powder’ is likely to find its way through to corporate deals, either through companies themselves or investors in private equity funds. The amount of ‘dry powder’ is huge: Morgan Stanley estimates that global non-financial companies hold $5.6 trillion in cash, while private investors sit on $2.5tn.

As would be expected, M&A activity is seen as likely to be particularly strong in certain regions and sectors over others.

The US will inevitably see a lot of activity through non-financial deals, this is likely to be towards the second half of the year and more apparent in Private Market deals. A lot of this activity gains less visibility since many of the deals are not whole-company takeovers, but partial takeovers or “carve-outs”. In public markets, there is a lot of necessary consolidation to come soon among US regional banks, born out of their weakened conditions following the spike in short rates. Real Estate will also see many deals, much of which will happen in private.

Europe has seen very low levels of M&A activity thanks to severe economic weaknesses over the last few years. This is already turning around as the continent recovers from its lowest point of the cycle, and Morgan Stanley expects Europe to lead the recovery in M&A. Indeed, it is already ahead of other areas. Economic confidence is returning after some difficult years, but companies are keenly aware they need scale to take advantage of it. This is a recipe for flurrying M&A activity.

Japan is benefitting from strong optimism. Some of this emanates from a cyclical swing, with exports growing in reaction to an expected rebound in global (in particular, Chinese) demand, and to the sharp decline in the Yen. The longer-term story for Japan is one of improving corporate structures and reforms to corporate governance. This, and an increased openness to foreign ownership, mean there are deals to be done. The fact Japan still has an extraordinarily loose monetary policy compared to other developed markets, should mean there is plenty of opportunity too.

In equity sectors, Morgan Stanley believes that financials are likely to lead the way. As mentioned, US banks are likely to see activity soon, while in Europe asset managers should continue to consolidate. In non- financials, European telecoms are fragmented and are desperate to find cost-savings. Globally-focused energy (which has already seen some big deals), health, and technology, also stand out as areas of potential activity. There will be more local deals in real estate and consumer staples. It is likely that much of this will happen within private markets.

If global M&A does come through as strongly as predicted, it could have some interesting effects on markets overall. Though M&As have been hard to come by in the last few years, capital market returns have not. In particular, growth firms – particularly US tech companies – have had a very good run. So-called ‘value’ stocks have not seen as much love, but mergers and acquisitions are in many ways all about value – with acquirers trying to unlock underutilised value or equally sized firms trying to achieve a value greater than the sum of their parts.

Buying activity in value assets could mean a rotation away from growth assets. This is related to the potential rotation away from the dominant US, as we have written about before. For a long period, market returns have been focused on the big winners, but when M&A activity picks up it is inevitably not the big winners that become targets – since they are just too big. A broad increase in M&A activity should mean more money going into equity markets, which will benefit all. But, those who have benefitted for so long from the big winners will have less to gain.

If anybody wants to be added or removed from the distribution list, please email enquiries@cambridgeinvestments.co.uk

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg/FactSet and is only valid for the publication date of this document.

The value of your investments can go down as well as up and you may get back less than you originally invested.