Published

10th June 2024

Categories

Perspective News, The Cambridge Weekly

Share

The Cambridge Weekly –10th June 2024

ECB’s Lagard makes rate cut history

Rate cuts at last. In a heavily anticipated decision, the European Central Bank (ECB) cut interest rates for the first time in five years last Thursday. Perhaps more poignantly, it was the very first time in its 25 years existence that the ECB cut before the US Fed. European stocks rallied in the build up, and got another boost following the decision and accompanying commentary. They were not the only ones: US equities had another strong week, with focus again on the dominant mega tech sector. Underlying the global equity rally was a sharp move down in bond yields – which make stocks more attractive by comparison, while stimulating business investment and demand. Markets are excited about easier monetary policy yet again.

Is three the new two?

The ECB was not the first major central bank to cut rates; the Bank of Canada (BoC) beat them to the punch last Wednesday, becoming the first G7 central bank to lower rates during this monetary cycle. Both the BoC and the ECB delivered 25 basis point cuts, and spoke of inflation coming closer to the 2% target, allowing less restrictive policy. ECB president Christine Lagarde said this likely marked the start of a “dialling back”, but the bank warned it was “not pre-committing to a particular rate path”.

Nobody expects this to be the start of a full-blown easing cycle from the ECB. In fact, implied market expectations for a second rate cut in September fell slightly in the aftermath – from 70% to 60%. But markets certainly expect the direction of travel to be down in the medium-term: the Bank of England is set to follow suit in the summer, however, after stronger-than-expected employment data from the US, expectations of an all-important US Federal Reserve (Fed) cut in the autumn have once again moved towards the end of year horizon.

This is happening while inflation remains consistently above the official 2% target, though. Indeed, the ECB does not think inflation will fall below that until late 2025 – but they are cutting rates regardless. It begs the question of whether central banks have implicitly moved to a 3% target instead. As we wrote recently, 2% is pretty arbitrary and, given dramatic shifts in the global economic structure – both recent and expected – there is a case to be made that a slightly higher target might better allow for stable growth.

This is truest in the US. Growth and inflation have been above expectation for so long – pushing the timeline for Fed cuts further and further back in the early part of this year. But expectations have now stabilised, and it emerged last Wednesday that the US added fewer jobs than expected in May. That reinforced markets’ expectations of rate cuts both this year and next. The Fed is not expected to hit its official 2% target anytime soon, but everyone expects it to push ahead with a new rate cycle anyway. Markets find that very comforting.

Goldilocks returns

We wrote last week that equity gains were now more based on the strong profits being generated by US companies – in particular tech firms – than expectations of easier financial conditions. But last week’s action was all about what central banks have done or will do. Bond yields fell significantly, and this delivered a sizeable boost for stock valuations and, therefore, prices. Does this challenge our assessment that fundamentals are driving markets?

Not exactly. Rate expectations were the key factor last week, but returns are still laser focused on companies that will produce the greatest profit growth. Investors’ darling Nvidia is perhaps the greatest example of this. The AI chipmaker is the world’s leading ‘growth’ company, and as such has massively benefitted from the move down in yields. But its outperformance – up an incredible 151% year-to-date, versus just 6.5% for the S&P 500 when excluding the so-called “magnificent seven” – is fuelled by its incredible profit growth. Q1 profits were up 600% from the year before, and it is expected to dominate the AI chip space in the years ahead.

This is the ‘goldilocks’ environment that markets long for. Growth is moderating enough for central banks to cut rates and start a new cycle, but is not weak enough to really hamper incredible profitability from business investment and resilient consumer demand. A key sign of this is that expected stock market volatility has fallen dramatically, and the cost of hedging positions against losses has dropped – suggesting that markets are in a mood to buy. The speed with which Saudi Aramco’s $12 billion share sale was gobbled up by markets last week is testament to that too. Say it quietly, but markets look positioned for another leg up.

On elections and markets

Lastly, a note about elections. Less than a month away from a UK election that is widely expected to end 14 years of Conservative government, investors understandably want to know how it might affect their portfolios. As we have written before, the answer is very little – at least in the short-to-medium-term. Keir Starmer’s Labour Party has effectively committed to continuity in near-term fiscal policy, and any impactful tax rises will likely be far down the line.

Still, recent elections in Mexico, India and South Africa have shown that surprise results – even if the end result is something markets seem to broadly favour – can cause temporary stock market swings. The selloffs following the Brexit referendum and Donald Trump’s surprise victory in 2016 are also prominent examples.

Bloomberg’s John Authers covered this phenomenon in a column last week, and had soothing advice for investors. Betting on election results is risky, thanks to opinion polls usually having a wide margin of error, and markets generally being bad at predicting what politicians will do once in office. Mexico’s outgoing president Andrés Manuel López Obrador, for example, was seen as a dangerous leftist that could tank the economy, but ended his tenure as the only Mexican leader in modern history to leave the peso stronger than he found it.

Even if elections cause downward swings, in the short term, these tend to be overreactions which are quickly recovered – as after Brexit and Trump. Politics can make a difference to regional economic dynamics over the longer term, as the Brexit vote also showed, but such occurrences tend to be reserved for the very large turns in economic policy. We do not expect these UK elections to have a big impact on domestic, let alone global, markets. But even if it did, it would probably mean a short-term buying opportunity. It would take a lot to really upset markets at the moment.

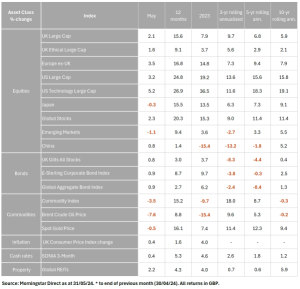

May 2024 asset returns review

May was decent for global investors. Global stocks gained 2.3% in sterling terms, reversing the losses we saw in April. This also meant new all-time highs for several major stock indices, though with relatively little fanfare. Underlying the return to positive capital market returns were strong corporate earnings and fewer fears about interest rates staying higher for longer, after US inflation finally resumed its downward path. Rates will not fall as hard or as fast as hoped earlier in the year, but the path downward is practically confirmed. Perhaps more importantly, there was a sense that economic growth and profits are strong enough not to need central bank support – particularly in the US. The table below shows May’s sterling returns in full.

Data showed inflation falling in most major economies, helping solidify rate cut expectations and thereby pushing global bond prices (the inverse of yields) up 0.9% through the month. Inflation momentum was not uniform, though. US headline inflation fell to 3.5%, April’s data showed, while core inflation (excluding volatile elements like food and energy) dropped to 3.6%. These were in line with economists’ expectations and, for core prices, represented the lowest level since 2021. But inflation exceeded expectations in the UK and Europe, at both core and headline levels.

Surprisingly high inflation this side of the Atlantic did not deter the ECB from delivering its first rate cut last week – and is not expected to deter the Bank of England (BoE) from cutting soon. Meanwhile, the fact US inflation was not above expectations – as it had been since the start of this year – was enough to convince markets that the Federal Reserve will cut rates in the Autumn. Bets on further rate cuts, particularly from the BoE and ECB, have been dialled back, but markets seem to be relaxed about that prospect.

The best performing equity grouping was yet again large-cap US tech, jumping 5.2% in sterling terms. But this was less about rate cut expectations (lower interest rates push up the near-term valuations of growth companies like tech) and more about stellar first quarter earnings reports. The undisputed winner was yet again AI chipmaker Nvidia – whose profits soared 600% year-on-year in Q1.

Interestingly, companies that did not quite live up to the hype were punished by stock traders. Shares in US software company Salesforce fell 20% in a single day after results showed growth of just 10% against projections of 20%. The harsh reaction tells us that stock market growth is based on strong fundamentals. This is a far cry from the ‘valuation vertigo’ concerns earlier in the year, and bodes well for stable equity growth.

Growth is less strong in the UK and Europe, but stock markets still managed to rally 2.1% and 3.5% respectively in May. The flipside of relatively damper economic prospects is that the BoE and ECB have more room to cut rates. Markets correctly priced in a June rate cut from the ECB – which it delivered at its meeting last week – while the BoE is strongly expected to follow suit in August or September.

Elsewhere, Chinese stocks finished the month slightly up at 0.8% after an up and down month. That uptick still puts China among the top performing regions over the last three months, returning 8.8%, following continued economic support from the government and signs that businesses are growing in confidence.

China’s performance was not enough to drive wider emerging markets, though, with EM stocks down 1.1% in sterling terms through May. The US dollar has been strong in recent months, which is often bad news for EM businesses with dollar-denominated debts. Currency troubles were a theme for EMs, as election results in Mexico, India and South Africa caused wide swings and laid the ground for a difficult period in EM equities.

One of the worst performing currencies – not just in May but for the year so far – was the Japanese yen. The huge difference in Japanese interest rates compared to the US has pushed capital from the former to the latter, to such an extent that the Japanese government had to prop up the yen’s value last month. This is one of the key reasons Japanese stocks were down 0.3% in sterling terms last month, despite a positive backdrop for Japanese businesses.

Commodity prices were also down, falling 3.5% in sterling terms. This is largely down to a 7.6% slide in brent crude oil prices, which came after signs of weakening global demand. Surprisingly, OPEC+ has since announced plans to boost supply, further adding to oil’s decline at the start of June. In terms of global growth and inflation, falling commodity prices – particularly oil – will almost certainly be a positive, removing a key price pressure.

Overall, May was an encouraging month for investors, even if returns were not as strong as earlier in the year. Not only did markets recover their April losses and hit all-time highs, but fears about stretched and unsustainable valuations have virtually disappeared, as it has become clear that stock prices are based on upgrades to expected long-term earnings. Where those earnings are not expected to be as strong, monetary policy is likely to be more accommodative, and vice versa. The result is a healthy system of market checks and balances, laying the ground for strong returns with little danger of boom and bust.

If anybody wants to be added or removed from the distribution list, please email enquiries@cambridgeinvestments.co.uk

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg/FactSet and is only valid for the publication date of this document.

The value of your investments can go down as well as up and you may get back less than you originally invested.