Published

13th May 2024

Categories

Perspective News, The Cambridge Weekly

Share

The Cambridge Weekly –13th May 2024

A blooming May for the UK

Stocks and bonds have had a good week again, revelling in the after-effects of the previous week’s US Federal Reserve meeting, and signals of a tepid US jobs market in the April employment report. Hong Kong stocks did particularly well, after the Chinese authorities were said to be considering tax waivers on Chinese stocks bought through the island’s Stocks Connect system. Here in the UK, the UK Large-Cap index stormed above 8400, helped by the Bank of England’s Andrew Bailey outdoing Jerome Powell, of the US Federal Reserve, in dovishness. So far, at least, there are few takers for the old adage “sell in May and go away”.

For US stocks, there was mixed news in the final datapoint of last week. The University of Michigan published its consumer sentiment index which fell sharply to 67.4 from 77.2. While this might indicate slower growth expectations, it seems perhaps more to do with rising inflation expectations. Year-ahead inflation expectations rose to 3.5% and longer-term expectations rose to 3.1% from 3%. The initial market reaction was mixed, with bond yields rising slightly and shares unchanged. Starbucks and McDonalds also signalled that US consumers may be feeling less flush in first quarter results.

The UK’s economy experienced some growth in the first part of this year, rebounding somewhat from the contractions of the previous two quarters. January to March showed a stronger-than-expected rise in ‘real’ GDP (real means adjusted for inflation), rising by 0.6% over the quarter. The economy’s bright spots appear to be some surprising strength in manufacturing and services, with construction being a laggard. Even better news is that investment spending has been a positive, even though consumption undershot expectations.

Fortunately, expectations of UK inflation are falling back, according to the Decision Maker’s Panel, an input for the Bank of England’s (BoE) Monetary Policy Committee (MPC). Inflation is now expected to be +2.9% year-on-year in April 2025, versus the Panel’s +3.2% expectation previously. After the Bank of England MPC’s May meeting (concluded last Thursday), Governor Andrew Bailey felt able to indicate that shortterm interest rates are likely to be cut. Most now think this will be at the next meeting on Thursday June 20th. Huw Pill, the BoE’s chief economist, pointed to declining pressures in persistent inflationary components in a speech last Friday.

There is some concern that growth may be accelerating a little too early for a June rate cut. Recent UK Purchasing Manager Indices, an indicator of business confidence, have been strong, and stronger than most other nations. Meanwhile, the weakness of construction could be short-lived if mortgage rates fall back quickly, given the strong underlying housing demand as exhibited in Royal Institute of Chartered Surveyors’ (RICS) residential survey last week. Although near-term house price rises are not showing up, estate agents expect price rises over the rest of this year and in 2025. The RICS “balance” measure will probably mean rises of about 4-5% in the next year, according to Pantheon Macroeconomics. The BoE forecast has GDP being relatively weak in the second quarter (at +0.2% quarter-on-quarter, equivalent to +0.8% annualised) so we could find the external member hawks in the ascendancy in five weeks’ time.

Still, like the Federal Reserve and the European Central Bank, the BoE members appear to be convinced that better real growth is not feeding through into longer-term inflation pressures. More importantly, investors seem happy to believe that they are not mistaken, and have pushed interest rate expectations lower accordingly.

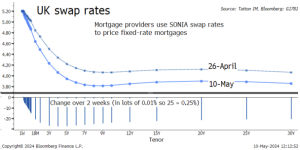

In turn, as the chart below shows, UK yields have fallen quite sharply in the past two weeks, with the bulk of the shift lower happening last week. Gilt prices have risen, and so too have UK equities.

Relative to other country indices, the UK Large-Cap index underperformed from January into March. Since April it has outperformed and now, year-to-date, is on a par with most other markets in total return Sterling terms. However, this stock market outperformance is probably down to factors outside the real domestic economy. For example, HSBC’s rise has some links to Hong Kong’s rebound, while Anglo American – a global mining company being bought by other global companies – has rallied thanks to takeover talk.

The UK smaller company indices have many globally focused companies as well, but they are predominantly affected by UK (and European) factors. Financial conditions have been much tighter for smaller companies in the UK and beyond for a long time. Companies that generate strong levels of free cash flow have benefitted, but any enterprise that needs capital has been compressed.

The MPC’s easier tone is a welcome boost for UK companies’ prospects and that has been reflected in the performance of both the FTSE250 and the AIM market. While they are yet to outperform the UK LargeCap index, at least they are now performing in line – a good thing when the UK Large-Cap index is doing well.

It is also interesting to note that, while US yields have declined, UK yields have fallen more. Sterling has remained stable against the US Dollar at just above $1.25/£. Likewise, the Yen has weakened slightly against the US dollar, now back above Y155/$, despite Japanese yields rising (rather than falling) last week. It is often assumed that currencies move because of changes in interest-rate differences between countries and, recently, the correlation between yield differentials and currency pairs has been quite strong. Perhaps we are entering a period where this is less so.

Politics may be one reason to think this might be the case. Last week, the Financial Times wrote about the similarity in economic policy between the policies of the current Chancellor of the Exchequer, Jermey Hunt, and the Labour shadow, Rachel Reeves. The FT terms the policy mix as “Heevesian” and we made a similar point after the Spring budget!

While the estimable Paul Johnson of the Institute for Fiscal Studies thinks that their shared goal of reducing the ratio of government debt-to-GDP over the next five years is “daft”, the Office of Budget Responsibility thinks it credible that it will happen. According to Oxford Economics Forecasting, the current level debtto-GDP is at 100% but will fall to 97% by 2030. Meanwhile, in the US, publicly held government debt will probably rise from 99% now to 109% in 2030, and that assumes that former president Trump’s ‘temporary’ tax allowances will cease.

In the past, investors have generally seen the prospect of a new Labour government as potentially problematic, but this does not seem to be the case this time around. Yet investors seem to have some disquiet about a prospective Republican presidency. It is possible that currencies may be ruled less by yield differentials and more by political differentials in the next few months.

UK stocks are enjoying a bit of time in the sun, after what feels like a long period in the cold. Maybe it has something to do with the improving weather.

What to take from a strong earnings season

Reporting for 2024’s first quarter corporate earnings is nearly over. The reporting covers mostly US-listed companies, and the results have been good, with profits growing at a surprisingly strong rate. Earnings per share for S&P 500 companies was 5.2% higher in the last quarter than a year before. Not only does that comfortably beat the 3.4% expected by analysts, but it represents corporate America’s strongest profit growth in almost two years.

US firms have seen profits coming from domestic demand, but the encouraging feature about this earnings season is that European firms have joined in the good times too. European corporate earnings have improved beyond expectations, despite previous signs of economic weakness. Analyst forecasts for the next 12 months have also bumped up considerably, and businesses are becoming more optimistic.

We wrote a few weeks ago about the great reports coming from European banks, and how this led to an increase in share buybacks. Swiss bank UBS promised to buy $2 billion of its own shares last month, following a strong Q1. It was the bank’s first quarter since being taken over by Credit Suisse, and last week the company reported a $1.8bn net profit for the first three months of the year – triple what analysts expected. Italian bank UniCredit also announced plans last week to distribute €10bn to investors after beating earnings forecasts.

The last quarter’s results are particularly important for a number of reasons. The timing means that we get to see profit reports from a wide range of companies around the world. Some firms only report earnings every six months or even yearly. But as Q1 2024 marks the end of the financial year, we have a broader picture of global corporate earnings.

More important is the global macroeconomic backdrop. Earlier in the year, capital markets were giddy about a ‘soft landing’ for global growth – whereby inflation slows enough for central banks to cut interest rates and start a new growth cycle, but not enough to overly damage the businesses still seeing out this cycle. The timeline for this shift was pushed further back as signs of persistent inflation and labour market strength came through – most clearly in the US – to the point where investors have started doubting it will actually happen.

This puts markets at a crossroads. On the one hand, rate cuts and the prospect of easier access to capital were what started this year’s rally. Any signs of inflation – like strong business or job market data – threaten those prospects. On the other hand, a stronger economy is better for corporate earnings, and those are what ultimately give stocks their value.

This back and forth has been played out in equity markets over the last few weeks. US stocks pulled back through April on stronger inflation data, but have clawed back a big chunk of those losses in May. That is thanks to a strange mix of strong earnings and weaker consumer data. The S&P bounced around and edged lower during last week, despite continued strength in earnings. Some commentators have called this a back and forth to either expecting a ‘soft landing’ or ‘no landing’.

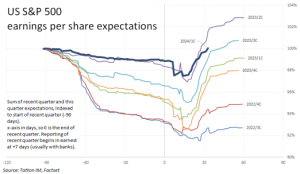

Q1 earnings point more towards the ‘no landing’ scenario, where growth or inflation strengthen without ever properly tailing off. We have become accustomed to firms beating analyst earnings forecasts – in part because they are often downgraded with the explicit aim of delivering a positive ‘surprise’ and getting a nice share price bump. What we do not always see is forward earnings outlooks being lifted as reports come through.

Over the course of each quarter, analysts revise their expectations as information moves from expectation to reality. In general analysts start out optimistic and then the companies do their best to temper it, without disturbing the longer term. As the quarter closes the companies want to show a better quarter than the analysts’ recently adjusted expectations, while starting the process of tempering the next quarter’s outlook. This manipulation is apparent and yet never really changes. We find the best way to look at quarterly expectations is to sum the recent and next quarter’s earnings and look for progress. The chart below shows how the past seven periods have shifted from the quarter’s start. The sum of 2024’s first and second quarter expectations was not downgraded very much, testament to the strong US domestic demand. Only the mid part of 2023 has been a recent better outcome.

Future growth expectations have been, and are, strong. At the start of March, S&P companies on average expected earnings for the second quarter of 2024 to grow 9% year-on-year. Now, earnings growth for the current quarter is projected at 9.8%. If that comes through, it would be the strongest earnings growth since late 2021, when US firms were coming off the back of a post-pandemic rush.

Further improvement is expected from here. Earnings for the third quarter are expected to dip a little to 8.6% growth, but this is back up to an incredible 17.3% earnings growth in the last quarter of 2023. In short, not only are earnings resilient, but on a growth path. This suggests reinvigoration of the current cycle, rather than a soft landing into the next one. This is also supported by businesses sentiment: the Wall Street Journal reported last week that mentions of “recession” in earnings reports or at investor events have dropped to the lowest point since early 2022.

Questions remain about where we go from here. For one, it is unclear how much of the current growth optimism among companies is itself influenced by rate cut expectations. These will continue to be tempered the longer that strength persists. Secondly, it is unclear how strongly these trends will be mirrored outside the US. European earnings have been strong, but the economy still looks weak, and the ECB is still on course to deliver rate cuts.

Whatever central banks do, the last earnings season is a good sign for equities over the long-term. Profitability is strong and corporate balance sheets have withstood the sharpest rate squeeze in a generation. Even if inflation continues, profits will continue alongside.

If anybody wants to be added or removed from the distribution list, please email enquiries@cambridgeinvestments.co.uk

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg/FactSet and is only valid for the publication date of this document.

The value of your investments can go down as well as up and you may get back less than you originally invested.