Published

7th May 2024

Categories

Perspective News, The Cambridge Weekly

Share

The Cambridge Weekly –7th May 2024

Still sticking to the plan

Equity and bond markets have had a reasonably good week, with policy makers helping to calm nerves. Geopolitical concerns retreated further; the US and Saudi Arabia are close to a bilateral agreement which may well include the formal recognition of Israel. Meanwhile, the first quarter’s results have been generally good, alongside some large buyback disbursements. Apple announced the largest ever forthcoming share purchase of $110bn, beating the previous largest by $10bn (which was also Apple in 2018).

The US Dollar slipped back after strong economic data from Europe and slightly less strong data from the US. It was also pushed lower by currency intervention by the Japanese Ministry of Finance, something some see as only a short-term stabilisation. The bigger factor was probably bond yields, with US yields falling and hence prices rising. The yield declines were most noticeable in shorter maturities.

Those yield falls were mostly because of the result of last week’s Federal Open Markets Committee (FOMC) monetary policy meeting. It had been highly anticipated, not for any rate move (there was none), but for the statement issued following the meeting and then, its chair, Jerome Powell’s press conference. We worried that FOMC members may conclude that financial conditions were too easy, and that inflation is no longer coming down.

When asked about the Federal Reserve’s (Fed) view that inflation was on a downward trajectory, Powell reiterated comments from a fortnight ago that “So far this year, the data have not given us that greater confidence … It is likely that gaining such greater confidence will take longer than previously expected.” Although that sounded worrying, most investors saw it as mildly comforting. Bond yields have risen enough since the last meeting to discount a slower path of rate cuts.

Regarding the possibility of a hike, he said that it was “clear” that policy is currently providing restraint in a “number of places”. The Committee would need to see “persuasive evidence” that policy has stopped being restrictive in order to tighten.

Investor views of central bankers flip-flop between liking and loathing. Currently, the Fed chairman is a bit of a darling. Last Wednesday, he told us that we shouldn’t worry, the US economy is being slowed gently. As if on cue, Friday’s employment report showed evidence that growth in jobs and pay has eased marginally.

We noted after the last meeting that the Fed seems to be determined to stick to the plan. They think the rate of inflation is still likely to decline towards the target and this week’s message, that the plan to cut rates is still on track, is clearly comforting for investors.

The message, and Friday’s employment data showing a slight rise in the unemployment rate to 3.9%, was enough to push the US 5-year treasury bond yield down sharply last week, from the previous Friday’s 4.70% to 4.45%, at the time of writing. The 0.25% fall is substantial and beneficial. At the same time, the economy is strong, as shown in solid sales growth – and the great news is that analysts are raising their margin expectations for next year as well. The pace of earnings-per-share upgrades is still accelerating as we go through the earnings season.

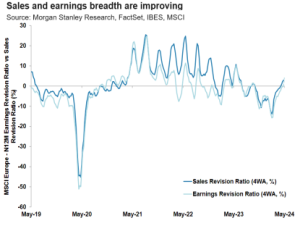

During last year, the US economy’s good fortunes did little for the rest of the world but, as we mentioned last week after the GDP data, perhaps that is changing. Europe’s economic data is starting to improve and now, so are company results. Morgan Stanley’s Europe strategists show the chart to the left, identifying the growth in both sales and earnings outlooks (N12M is next twelve months).

This doesn’t change the outlook for rates and investors still expect a cut in June, with various ECB members making it clear that they too wish to stick to their plan.

The UK, which is included in the broad Europe index shown above, has had three weeks of pretty great price performance, following a period of underperformance in the first quarter. Our economic data has also improved, as evidenced by the strong services Purchasing Manager Index for April. This was revised a little higher to 55 (from 54.9). 50 marks no growth, and 52 is usually associated with growth around potential (about +1% year-on-year for GDP), so this does indicate positivity. The recent poor weather has held back retail sales but perhaps businesses see sunshine ahead.

However, this may create an issue in its impact on this week’s Bank of England Monetary Policy Committee (MPC) meeting. Just as in the US, investors have adjusted expectations for rate cuts, factoring in a delay until September. The MPC has vocal hawks, and they may have some sway this time around, which may reverse some of the strong FTSE 100 performance.

Meanwhile, The Times reported last Thursday that Coutts has switched almost £2 billion of client money out of the UK-listed companies and into global markets. The private bank is cutting (and probably has already cut) UK allocation in six client funds from as much as 40% to between 1.9% and 3.5%, depending on the fund. The Times quoted Charles Hall, head of research at Peel Hunt, who estimated that this represented a £1.96 billion switch out of the UK and a “very material” outflow. These outflows amounted to £8 billion for the whole of last year, according to figures from Calastone, a fund services provider.

UK companies are about 3.5% of global market capitalisation in the MSCI All-Country World Index, which is our usual reference index for global stocks. Internally, we also discuss this issue frequently and the arguments for and against a home bias are more complicated than just long-term return. However, it continues to indicate how the UK’s domestic capital market is shrinking, running counter to the small efforts made by the Chancellor in the Spring Budget. Clearly, if we wish to reverse the decline, something more fundamental needs to happen. We will write about reasons for and against a home bias in the near future.

April 2024 asset returns review

April was challenging for investors. After a stellar start to 2024, the first quarter’s optimism faded and stock market returns were negative on the month for most regions. Overall, global stocks lost 2.4% of their value in sterling terms through April. Capital markets grappled with the fact that growth and inflation do not seem to be dropping away – most notably in the US. That has pros and cons: resilient growth means stronger corporate earnings, but sticky inflation means central banks cannot cut interest rates as soon or by as much as markets had expected. Even with the pullback, though, year-to-date returns are still strong. Since the market trough late last October, global stocks are up 36.2% in sterling terms – as the table of returns shows.

Underlying markets’ first real struggle of the year was a return to volatility. Trading was remarkably calm in the first three months of the year but that all changed in April as intraday trading became spiky. Large US technology companies – international investors’ long time favourite – experienced a substantial 24.8% trading volatility. This meant a heightened perception of market risks, accompanied with some of the standard signals of ‘risk-off’ behaviour. The US dollar, considered a safe-haven currency, gained value in the middle of the month.

The assets which fared worst were those that did best in the early part of the year. We see this in US tech, which lost 3.5% in April in sterling terms and underperformed not only other regions but the broader US stock market – which dropped 3.2% by comparison. But also in Japan, whose equities were the worst performers in April, returning -4%, yet is still one of the year’s best performing regions, up 7.5% in sterling terms year-to-date.

Japanese stocks saw the most volatility, with a 25.3% annualised figure for April. It was not just equities that were volatile either: the value of the yen fell dramatically through April and saw some massive intraday trading ranges. Higher Japanese inflation was offset by weak real economic activity. Investor positivity retreated somewhat, amid fears that expected profit growth may not be forthcoming. At one level, it was helpful that the April central bank meeting brought no change to short-term rates, but a dovish Bank of Japan also sent the yen to 160 against the dollar on Monday 29th – the weakest level in 34 years. Earlier this year, a falling yen was deemed to be a benefit for exporters but now the backdrop of rising input costs is now seen as suppressing domestic demand. The yen reversed sharply higher in later trade after Ministry of Finance intervention, another sign that the yen weakness is now being seen as creating problems.

There were equity markets with positive returns last month; UK, China and emerging markets, jumping 2.7%, 7.1% and 1.3% in sterling terms respectively. This keeps with the theme of changing fortunes, as all three have lagged behind Europe and the US since last October’s trough, though to massively varying degrees. China was by far April’s standout after a weak period. Not only is Beijing pledging ever more economic support, but the latest figures for high-tech manufacturing show it is having a positive impact.

The UK stock market benefitted last month from its large commodity-related companies, in particular BHP’s massive takeover bid for Anglo-American and perhaps also from the Bank of England’s relative dovishness compared to other central banks. The timelines for interest rate cuts are being delayed in the US, but the market thinks that the BoE remains on course to deliver its first cut in late summer. Despite hotter-than expected inflation figures, Britian’s inflation problem is probably drawing to a close.

Europe’s monthly returns were negative despite perceptions that European Central Bank (ECB) is also fairly dovish. The mild weakness of the Euro, the rise in energy and metals prices, and still tight labour markets caused some Governing Council members to sound more equivocal about rate cuts. We note there are some signs of returning European growth – and with it, some sticky inflation – but overall inflation looks steady rather than on the rise. The ECB continues to indicate a June cut but may not want to cut rates too quickly thereafter.

This is very different to the US, where growth and inflation numbers continue to show notable strength. As we wrote last week, headline US inflation figures rose in March amid strength in domestic demand. The US economy continues to defy expectations, and milder inflation numbers were only possible because of weaker import prices and businesses drawing down their inventories. The Fed keeps delaying its rate cut timeline in response, but has not yet suggested that another rate rise might be necessary. The longer US strength goes on, the more likely that drastic turnaround becomes.

Nobody thinks rate rises are likely, but markets have certainly had a bit of a reality check. The ‘immaculate disinflation’ narrative – that prices could come down and start a new cycle without hurting growth or company profits – propelled stocks from October until March, but it always looked a little too good to be true. The fact markets are realising this is not a bad thing.

The benefits of this higher growth, higher inflation environment, as markets are also realising, are strong corporate earnings. These are what ultimately give stocks their value, and the recent profit reports for the first quarter of the year have brought plenty of joy – particularly in the US. Market expectations became more realistic last month, but realism does not mean pessimism.

If anybody wants to be added or removed from the distribution list, please email enquiries@cambridgeinvestments.co.uk

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg/FactSet and is only valid for the publication date of this document.

The value of your investments can go down as well as up and you may get back less than you originally invested.